All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Presuming rate of interest rates remain solid, even greater assured prices might be feasible. It's a matter of what terms best match your investment needs. We tailor numerous methods to optimize growth, income, and returns. Making use of a laddering technique, your annuity profile renews every couple of years to make the most of liquidity. This is a smart strategy in today's enhancing rates of interest environment.

MYGA's are one of the most prominent and the most typical. With multi-year accounts, the price is locked in for your chosen period. Rates are assured by the insurer and will neither increase neither reduce over the chosen term. We see interest in short-term annuities offering 2, 3, and 5-year terms.

External Annuity Wholesaler Jobs

Which is best, straightforward passion or compounding interest annuities? The response to that depends on just how you utilize your account. If you don't plan on withdrawing your interest, then generally provides the greatest prices. A lot of insurer just provide compounding annuity plans. There are, nevertheless, a few policies that credit history simple rate of interest.

It all depends on the hidden rate of the dealt with annuity agreement, of program. Experienced dealt with annuity investors know their premiums and interest gains are 100% accessible at the end of their selected term.

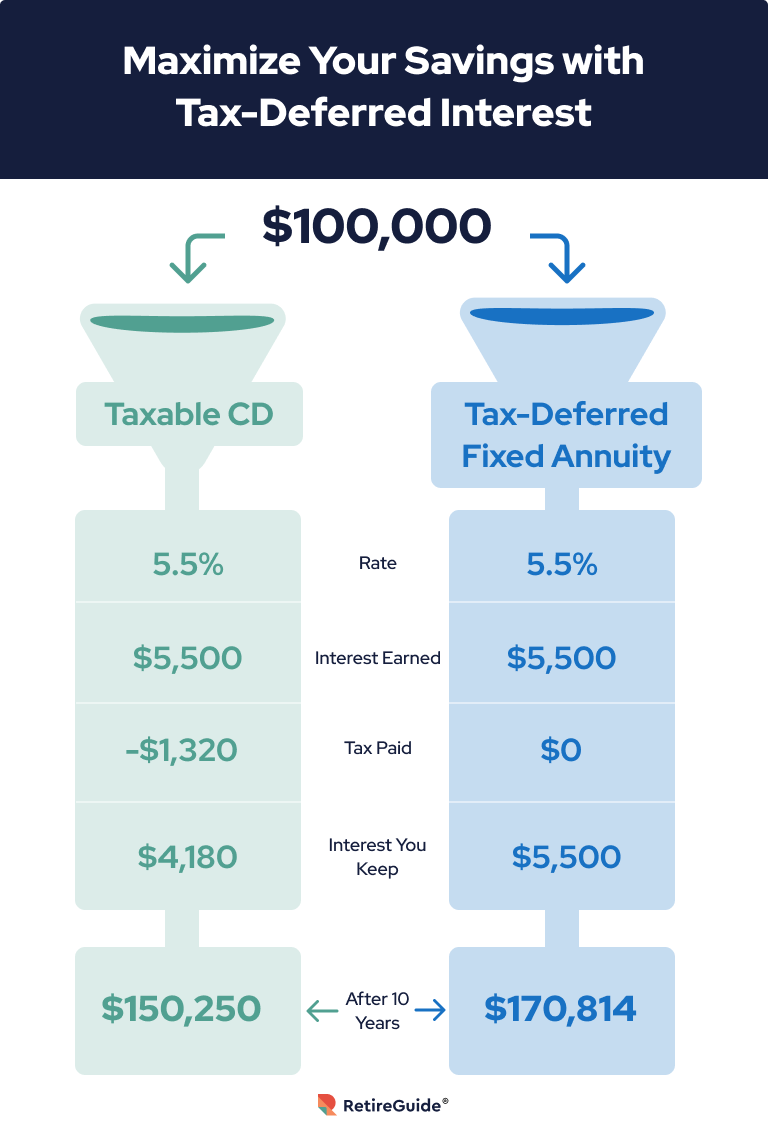

Unlike CDs, fixed annuity plans permit you to withdraw your rate of interest as earnings for as long as you desire. And annuities provide greater rates of return than virtually all similar financial institution instruments provided today.

There are several extremely ranked insurance business vying for deposits. There are several popular and highly-rated business providing competitive yields. And there are companies specializing in rating annuity insurance coverage firms.

Insurance firms are generally safe and safe and secure organizations. A few that you will certainly see above are Reliance Standard Life, sibling business Midland and North American Life, Americo, Oxford Life, American National, Royal Neighbors, Pacific Guardian Life, Athene, Sagicor, Global Atlantic, and Aspida to name a couple of.

View this short video clip to comprehend the similarities and distinctions between the two: Our clients purchase repaired annuities for numerous reasons. Safety and security of principal and guaranteed interest rates are absolutely 2 of the most essential aspects.

Nypd Annuity Fund

These policies are extremely flexible. You might wish to delay gains currently for bigger payments throughout retirement. We provide products for all circumstances. We help those needing instant rate of interest income now in addition to those planning for future earnings. It is necessary to note that if you need income currently, annuities work best for those over age 59 1/2.

Why function with us? We are an independent annuity brokerage firm with over 25 years of experience. We are certified with all carriers so you can go shopping and compare them in one location. Rates are scooting and we do not recognize what's on the perspective. We assist our clients lock in the highest possible returns feasible with risk-free and protected insurance provider.

Over the last few years, a wave of retiring child boomers and high rates of interest have helped gas record-breaking sales in the annuity market. From 2022 to 2024, annuity sales topped $1.1 trillion, according to Limra, a global research organization for the insurance coverage market. In 2023 alone, annuity sales boosted 23 percent over the prior year.

Gift Annuities Rates

With even more possible rates of interest cuts imminent, uncomplicated set annuities which often tend to be much less challenging than various other options on the market might end up being less interesting consumers because of their waning prices. In their place, other varieties, such as index-linked annuities, might see a bump as consumers seek to capture market growth.

These price walkings provided insurer area to use more enticing terms on fixed and fixed-index annuities. "Rate of interest on taken care of annuities likewise increased, making them an eye-catching financial investment," says Hodgens. Also after the securities market rebounded, netting a 24 percent gain in 2023, lingering worries of an economic downturn kept annuities in the limelight.

Various other aspects likewise added to the annuity sales boom, including even more banks currently using the items, claims Sheryl J. Moore, Chief Executive Officer of Wink Inc., an insurance market study company. "Customers are reading about annuities even more than they would certainly've in the past," she claims. It's additionally simpler to purchase an annuity than it utilized to be.

"Literally, you can make an application for an annuity with your agent through an iPad and the annuity is authorized after finishing an online type," Moore claims. "It used to take weeks to get an annuity through the issue procedure." Set annuities have propelled the current growth in the annuity market, representing over 40 percent of sales in 2023.

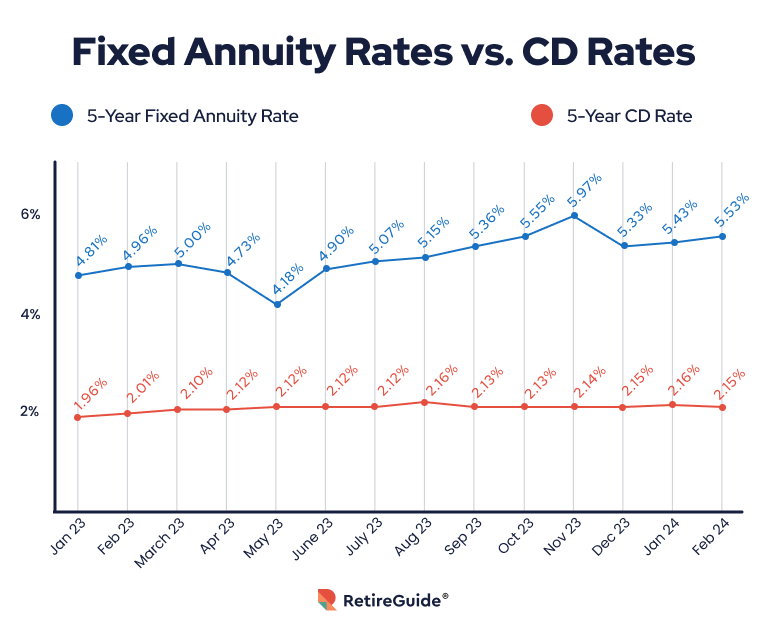

But Limra is anticipating a draw back in the appeal of dealt with annuities in 2025. Sales of fixed-rate deferred annuities are expected to go down 15 percent to 25 percent as rate of interest rates decline. Still, fixed annuities haven't shed their glimmer rather yet and are offering traditional investors an attractive return of even more than 5 percent in the meantime.

Annuity With Long Term Care Insurance

Variable annuities usually come with a laundry list of charges mortality expenses, administrative costs and investment monitoring fees, to name a couple of. Set annuities keep it lean, making them a less complex, less pricey option.

Annuities are intricate and a bit different from other monetary products. Discover how annuity costs and commissions function and the typical annuity terms that are handy to know. Fixed-index annuities (FIAs) damaged sales records for the third year in a row in 2024. Sales have actually almost increased because 2021, according to Limra.

Caps can differ based on the insurance company, and aren't most likely to remain high permanently. "As passion prices have been boiling down lately and are anticipated ahead down further in 2025, we would prepare for the cap or involvement prices to also boil down," Hodgens states. Hodgens prepares for FIAs will continue to be appealing in 2025, however if you remain in the market for a fixed-index annuity, there are a couple of points to keep an eye out for.

So in theory, these hybrid indices intend to ravel the highs and lows of an unstable market, but in fact, they have actually often failed for customers. "Several of these indices have returned bit to nothing over the past pair of years," Moore claims. That's a difficult tablet to swallow, thinking about the S&P 500 posted gains of 24 percent in 2023 and 23 percent in 2024.

Variable annuities when controlled the market, but that's changed in a huge means. These items experienced their worst sales on document in 2023, going down 17 percent contrasted to 2022, according to Limra.

Annuity Sales Lead

Unlike repaired annuities, which provide disadvantage security, or FIAs, which balance safety with some growth possibility, variable annuities supply little to no defense from market loss unless motorcyclists are added at an added cost. For investors whose leading concern is protecting funding, variable annuities merely don't gauge up. These items are also notoriously intricate with a background of high costs and hefty abandonment costs.

When the market collapsed, these cyclists came to be obligations for insurers because their ensured values exceeded the annuity account values. "So insurer repriced their cyclists to have less appealing features for a greater cost," says Moore. While the market has actually made some initiatives to improve openness and lower prices, the item's past has soured numerous customers and financial advisors, that still view variable annuities with hesitation.

Fidelity And Guaranty Annuity

RILAs supply consumers much higher caps than fixed-index annuities. Just how can insurance coverage companies afford to do this?

For instance, the vast array of attributing approaches utilized by RILAs can make it tough to compare one product to one more. Higher caps on returns also include a trade-off: You take on some danger of loss beyond an established flooring or buffer. This barrier shields your account from the initial portion of losses, typically 10 to 20 percent, yet afterwards, you'll lose money.

Latest Posts

Annuities Defined And Explained

Life To Annuity 1035 Exchange

Variable Annuity Hedging